Voter-Approved Physical Plant and Equipment Levy

https://www.benton.k12.ia.us/p...

September 13, 2022

Information, Question & Answers

Voter-Approved Physical Plant and Equipment Levy (VPPEL)

and why it is important for the Benton Community School District

THE BOARD OF DIRECTORS AT BENTON COMMUNITY SCHOOLS SUBMITTED A ballot regarding the Voter-approved Physical Plant and Equipment Levy (VPPEL) for September 13, 2022, Special Election. Benton Community has participated in the PPEL for many years.

PPEL facts:

The $1.34 VPPEL is a Voter-approved Physical Plant and Equipment Levy authorized by Chapter 298 of the Iowa Code. The VPPEL is a maximum of 10 years. The revenues are restricted to school building improvements, repairs, maintenance, technology upgrades, purchasing school buses, or new construction.

The current voter-approved P.P.E.L. expired in 2010 and was used to improve district facilities and transportation. The District was able to generate an average of $649,378 per year on the $1.34 VPPEL.

If passed, this VPPEL would generate approximately $1,009,612 per year to be used for safety and security, as well as renovations for some of our classrooms, heating and cooling systems (HVAC), purchasing new technologies, and school buses. The VPPEL will be critical for funding these needed improvements but it will not be enough to do everything to improve and upgrade facilities and classrooms. Depending on the future master Facilities Plan and funding, the VPPEL together with other future revenue could fund building expansions at Atkins Elementary and other facility improvements.

The ballot language will be to request a $1.34 VPPEL funded with 100% property tax. The vote for the PPEL requires a 50% +1 majority to be approved.

Why is the school board requesting the voters to renew the VPPEL now?

The previous VPPEL expired in 2010 and since then, our facilities are in need of improvements for safety and security, as well as renovations for some of our classrooms, heating and cooling systems (HVAC), purchasing new technologies, and school buses.

To assure facility improvements and school buses necessary to transport students, the Board is requesting the VPPEL to be on the Sept. 13 ballot.

Where to vote on Sept. 13

Polling locations will be open from 7:00 a.m. - 8:00 p.m. at the following locations. Registered voters in our school district communities can go to any one of the following locations and vote.

Van Horne Community Center

Newhall City Hall

St. Michael’s Parish Center

Atkins City Hall/Library

Keystone City Hall

Blairstown City Hall/Community Center

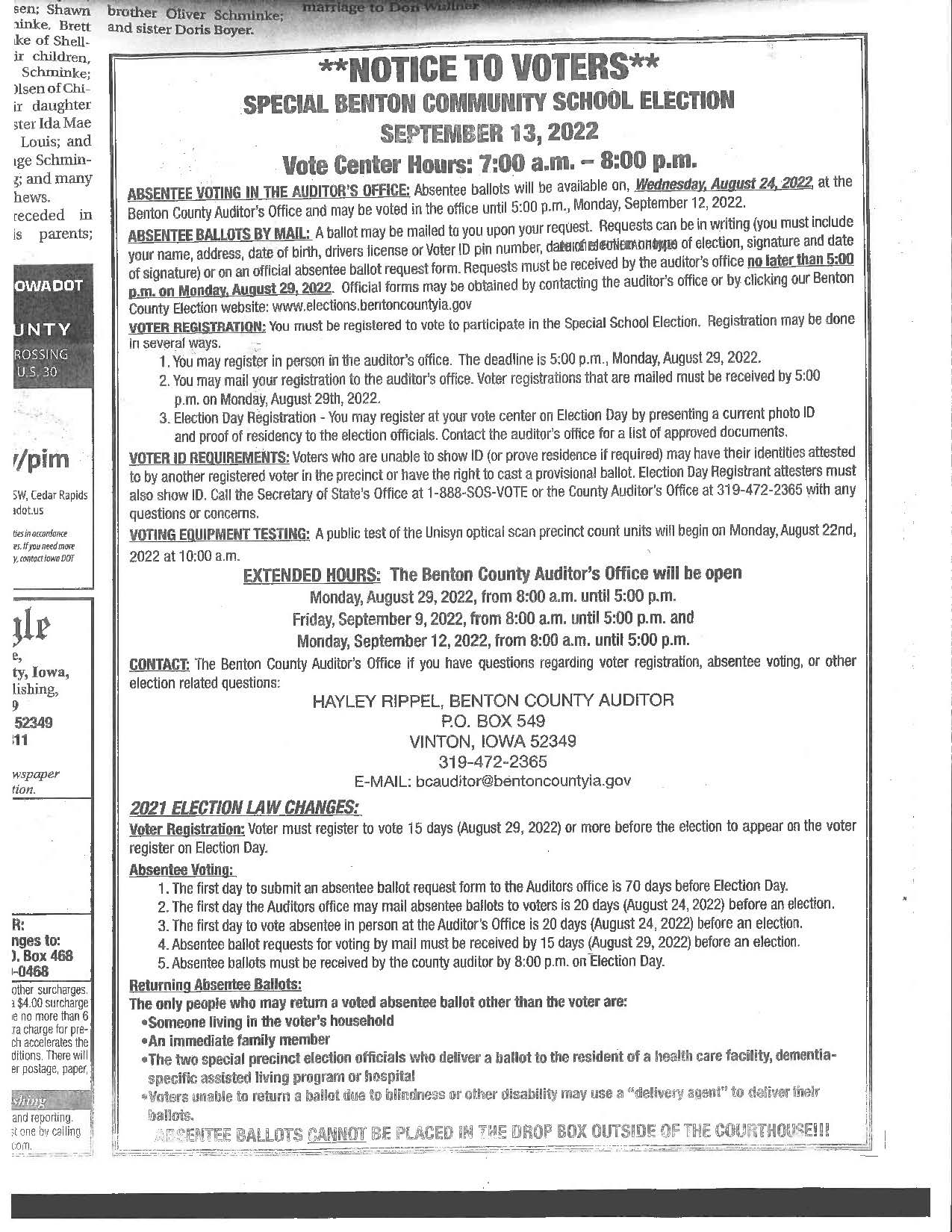

Absentee Ballot information: Please see the information from the Benton Co. Auditor shown below ......if requesting voter registration, absentee voting, or other election-related questions.

Hayley Rippel, Benton County Auditor P.O. Box 549 Vinton, Iowa 52349 319-472-2365 E-Mail: bcauditor@bentoncountyia.gov

Frequently asked questions:

What is the VPPEL?

VPPEL stands for Voter-Approved Physical Plant and Equipment Levy. PPEL provides the necessary funds to maintain and improve school buildings, complete site improvements, purchase transportation vehicles, and purchase new technologies and school equipment. PPEL is an annual property tax levy. It is not a bond issue.

When did the school district last have the VPPEL and what did they use it for?

Most recently, the school district had the VPPEL from 2000 - 2010. The school district used the funds for school building improvements and purchasing school buses.

Why is the school board asking for the VPPEL now?

The school district has not had the VPPEL for 12 years. During this time, we were able to keep up with deferred maintenance and repairs but now are in need of making more substantial improvements. The revenue from the VPPEL will be used for these purposes.

What will it be used for?

Our school facilities are very nice but they are aging. Improvements are needed for safety and security as well as renovations for some of our classrooms, heating and cooling systems, purchasing new technologies, and school buses.

What is the levy amount?

PPEL is limited to $1.34 of taxable property valuation. Benton Community has not had the VPPEL since 2010. If voted and implemented, the levy will be in place for 10 years.

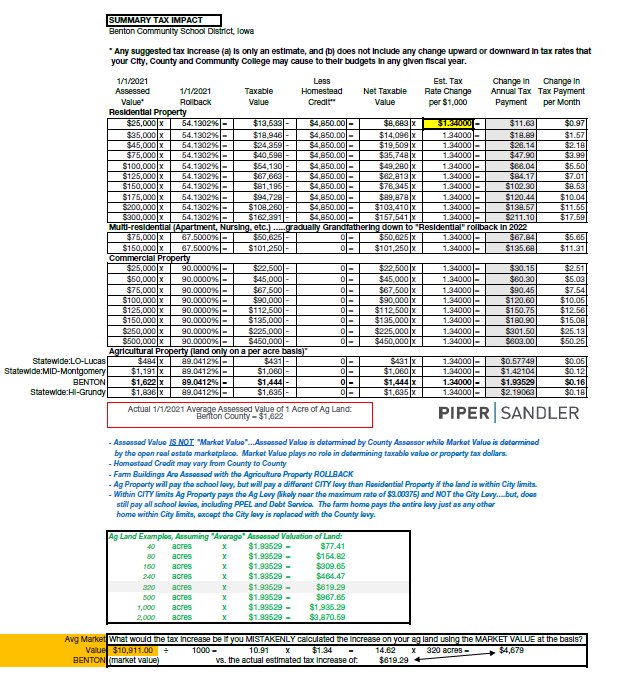

How will this impact my property taxes?

Please refer to the “Summary Tax Impact” information shown below.

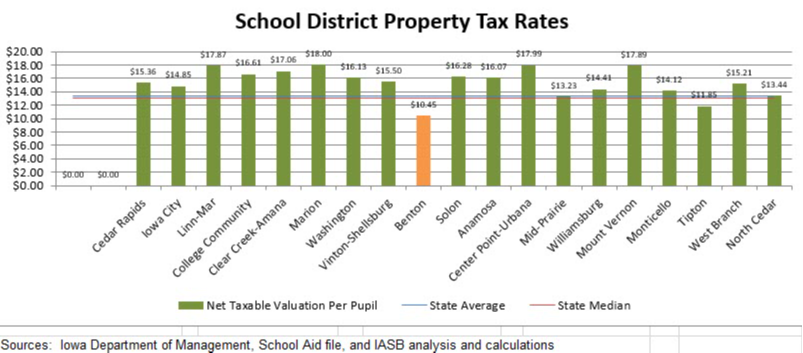

School District property tax rates for Benton Community have been low for many years in comparison to all schools around us (see chart below) and will drop even lower for this upcoming year to $9.70. While this is certainly a great situation for all of our communities and residents, a low rate over a long period of time eventually takes a toll when it comes to needing facility improvements, transitioning to 21st-century learning environments, purchasing buses, and upgrading our older HVAC and security systems.

When parents move into our school district, they are typically well aware of the ongoing improvements and newer-more-contemporary school buildings and facilities in the surrounding school districts. We are often asked by parents and students about our timeline for improving our facilities and bringing them “up to date” as other schools have done. It is critical that Benton Community continues to improve, challenge ourselves to be better, make upgrades, and increase student enrollment. Student enrollment is the single most important factor in the livelihood and success of a school district.

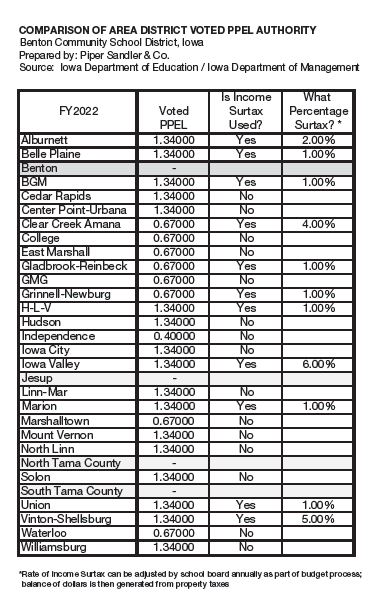

How many other area schools have the VPPEL?

26 other area school districts in eastern Iowa have the VPPEL. Please refer to the chart below.

What can the levy be used for?

The VPPEL can be used for facility improvements, technology, transportation, and other capital improvements.

The VPPEL ballot for September 13, 2022, is asking our voters to vote on the following:

"The District wishes to take action to allow voters to approve a Physical Plant and Equipment Levy consisting of a tax on all the taxable property in the school district of an amount not to exceed one dollar and thirty-four cents ($1.34) per one thousand dollars ($1,000.00) of assessed value in any one tax year for a period commencing on July 1, 2023, not to exceed ten (10) years."

------------------------------------------------------------------------------------------------------------------

The Board did not include income surtax as part of the $1.34 levy election and vote for September 13th.

The following questions and answers explain what an income surtax involves as well as the reason the Board decided NOT to include an income surtax in the Voter-Approved Physical Plant and Equipment Levy.

Why was the income surtax not used with the VPPEL for the Sept. 13 vote?

To be able to use the revenue generated from the VPPEL even as soon as next summer if the Board decided to begin the improvement projects, they would not be able to borrow against the VPPEL revenue if the income surtax is used. This would restrict the Board to move forward with the improvement projects. The law does not allow income surtax to be borrowed against nor used to pay on PPEL notes or principal and interest of the revenue from the VPPEL.

How is income surtax figured and what are the minimum and maximum amounts allowed?

Districts that elect to use income surtax must have a minimum of 1% income surtax.

For example, if the Board would have included income surtax:

The formula used by the auditor and state office as per the law is shown below: This is just an example:

The state uses the amount of 2020 income taxes paid by all Benton Community School District residents.....

Then, if a 1% income surtax is applied, the income surtax is figured from the total of the 2020 income taxes paid. For example, if the total of all Benton CSD residents of income taxes paid in 2020 was $1,009,612.00, a 1% income surtax would be $119,819

The maximum surtax would be 8%. The maximum percent is computed by the combined surtax PLUS the property tax amount but it cannot be MORE than what the $1.34 in property taxes would have otherwise produced.

If the income surtax was 8%, only $51,000 would be generated from property taxes. This amount would not generate any meaningful amount of revenue to borrow and fund the improvement projects necessary for safety and security, purchasing buses, building improvements, or purchasing new technologies and school equipment.

NOTE:

The 8% high limit could be different each year in the future depending on (a) total income taxes paid by citizens and (b) taxable property valuation at that time. So, it’s possible that in some future year, the District may only have been able to levy 7% or 6% at most. (this is a hypothetical example due to the fact the income surtax is NOT included in this Special Election vote).

Questions?

Please contact Dr. Pamela Ewell, Superintendent, or Dr. James Bieschke, School Business Official - 319-228-8701 Ext. 1502 or 1503

Summary of Tax Impact shown below

2

022 School District Property Tax Rates